In his Party Conference speech on 20th September, the Deputy Prime Minister, Nick Clegg, committed to empowering local authorities with the ability to raise development funds from Tax Increment Financing (TIF). This will allow councils to borrow against future additional property tax revenues (in this case, Business Rates) from new developments to support the initial costs of a facilitating project, such as a new transport scheme. Elsewhere, TIF has revolutionised the way local transport and other development schemes are funded. Will Nick Clegg’s announcement do the same in the UK?

Background

The idea of Tax Increment Financing was initially floated in the US in the 1940s (Carroll, 1999) and the first scheme was employed in 1952 in California as a means of raising local funds to match federal grants (Dye and Merriman, 2006). Following the recession of the mid 1970s (Klemanski, 1990) and the withdrawal of federal urban development funds in 1978 (Briffault, 2010), TIF proliferated dramatically throughout the US. Today, it has come to dominate local economic development policy. All states except Arizona permit TIF, and it has been employed in every type of community, from Central Business Districts to farmland on the urban periphery (Naccarato, 2007). Chicago’s mayor, Richard M Daley, describes it as “the only game in town”.

In recent years, TIF has also spread beyond the borders of the US. A number of Canadian states, including Ontario and Alberta have passed TIF legislation, and the method is being investigated in Australia.

How it Works

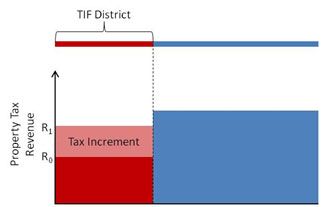

TIF laws vary between locations, but the broad principles are the same. The figure below helps illustrate the idea. The line in the upper part of the figure represents a city, and the graph below the line shows the tax revenue collected in that part of the city. Initially, a geographic area is designated as the TIF district. In the figure, this is the red section, in which property tax revenues are R0. Debt is issued and the proceeds used to fund improvements in the district. In principle, the development leads to higher tax revenues as firms and individuals relocate to the area and property values rise, say R1 on the graph. These additional tax proceeds, called the tax increment, are then set aside to repay the debt (Naccarato, 2007).

The Benefits

TIF’s proponents cite evidence from states such as Wisconsin (Carroll, 1999) and Indiana (Man and Rosentraub, 1998) suggesting that TIF programmes lead to dramatic increases in property values (see also Portland case study below). Transport projects seem especially powerful in this regard. For instance, estimates suggest an increase in house values of 32% within 100ft of the MetroLink Light Railway System in St Louis, Missouri (Centre for Transit-Oriented Development, 2008). Advocates also claim that TIF schemes create jobs and increase local wages (Michel, 1996). Moreover, evidence suggests that the benefits of certain types of TIF initiatives spill over to neighbouring districts (Weber et al, 2007).

Case Study – Portland, Oregon: In the early 1990s, downtown Portland was dominated by dilapidated warehouses and office blocks. A plan was hatched in 1994 to redevelop two large brownfield areas and to connect them with a tram service. The initial phases of the tram network cost $103m, of which $22m was raised using TIF (Portland Streetcar Inc, 2008). Passenger services began in 2001 and weekday ridership now stands at around 12,000. The economic impact has been substantial. Many areas near the line saw increases in property value in excess of 400% between 2003 and 2008, and by 2008 $3.5bn of new development had sprung up along the route (Brookings, 2009).

Proponents suggest that TIF offers a means of self-financing for developments, permitting local governments to fund schemes without the need to bare large up-front costs. At the same time, it requires no increase in tax rates (Donaghy et al, 1999). It is often suggested that, relative to other funding mechanisms, TIF is simple to administer and avoids delays associated with intergovernmental transfers (Klemanski, 1990). In addition, once the debt has been repaid, governments benefit from the increased tax revenue from the development (Kelsay, 2007).

The Risks

Despite these advantages, TIF is by no means universally admired. Most visible is the problem that developments may fail in increasing tax revenues, so that local governments are left with a debt burden which has to be repaid by cutting back on services or increasing taxes (Brueckner, 2001). A study in Kansas City, Missouri, found that only a quarter of schemes met revenue targets (Kelsay, 2007).

Opponents of TIF suggest that, even if a scheme is successful, and tax revenue does increase, then different but equally pernicious problems can arise. For example, if local residents are priced out of the housing market. This can result in the displacement of residents to other deprived areas, and the overall effect can simply be to shift concentrations of poverty from one place to another (Michel, 1996).

Detractors also argue that TIF schemes simply redirect investment from one location to another, and promote competition for investment between neighbours. This appears to have been a particularly acute problem in the US (Byrne, 2002; Anderson and Wassmer, 2000; Gibson, 2003). In the twin cities of Minneapolis and St Paul, Minnesota, TIF programmes in wealthy suburbs drew firms and jobs away from deprived inner city areas (Lefcoe, 2010).

Many TIF programmes have been criticised for using public funds in order to deliver projects that would anyway have been provided by the private sector. This results in tax revenue losses (see Chicago case study below) and exposes the public sector to avoidable financial risk.

Case Study: Chicago, Illinois: Legislation permitting TIF was passed in Illinois in 1977 (Byrne, 2006) and since then the city of Chicago has led the US in its use (Naccarato, 2007; Briffault, 2010). TIF districts cover a third of all city land (Centre for Transit-Oriented Development, 2008). The city’s downtown loop district was the largest TIF district in the US and raised some $1bn of revenues throughout its 23 year lifetime, which ended in 2008 (Briffault, 2010). Transport projects have featured heavily in Chicago, with TIF raising $13.5m for development of Randolph/Washington Station (Casella, 2002) and $40m for redevelopment of Morgan Street Station. Mistakes have nevertheless been made in the city. For instance, estimates suggest that the city lost over $250m of revenue in 2002 because TIF was used for projects that would have gone ahead anyway (Naccarato, 2007).

Lastly, TIF is, by its very nature, highly decentralised with decisions being made at a very local level (Briffault, 2010). TIF has been criticised for being unaccountable and lacking checks and balances, and suspicions of favouritism and corruption are common (Byrne, 2010 ; Lefcoe, 2010).

Possibilities in the UK

Mirroring the US several decades ago, UK interest in TIF has been borne out of economic downturn and budget cuts. Scotland’s devolution settlement permits TIF, and the city of Edinburgh has recently been given the green light to raise £84m in order to fund the redevelopment of the city’s waterfront. In England, London Mayor Boris Johnson has identified TIF as an option for financing extensions to the Northern Line.

Nick Clegg’s announcement provides little detail about how TIF will operate in the UK. However, the table below provides an illustration of what might be available. It shows the amount of TIF funding that local governments around the country might be able to raise for an infrastructure project that results in a major commercial development of 50,000 square meters. This is computed using DTZ’s Property Times series and business rates from the Valuation Office Agency. It assumes no small business concessions, that occupancy of the development is 90%, that 75% of additional revenues to be kept by local authorities, an interest rate of 5% and a 20 year repayment period. The impact is assumed to be on commercial property alone, so that the effect on council tax revenues is zero. Such a development is similar in magnitude to London’s 30 St Mary’s Axe (‘The Gherkin’), Cardiff’s Callaghan Square or two of Birmingham’s Colmore Plazas.

| Area |

Possible Tax Increment Financing Available |

| West End |

£99m |

| City of London |

£50m |

| Manchester |

£33m |

| Birmingham |

£32m |

| Bristol |

£30m |

| Leeds |

£29m |

| Cardiff |

£24m |

| Newcastle |

£22m |

| Nottingham |

£21m |

The potential amounts available through TIF are significant. However, in light of the associated risks witnessed earlier, releasing such funds will likely require careful analysis of the financial and economic implications of the proposed scheme. Indeed such requirements have been enshrined in state law in many instances in the US. Firstly, analysis of market failure, indicating that a scheme will not be delivered privately even though it will give rise to an overall benefit, will likely be important. Secondly, a complete consideration of the extent to which the economic activity promoted is genuinely new, as opposed to simple movement from elsewhere, is likely to be of paramount concern. Thirdly, whether the project is likely to generate sufficient tax receipts to cover the cost of the debt will need to be considered.

Conclusion

Following Nick Clegg’s announcement, TIF seems likely to claim a place at the top of the local transport planning and development agendas over the coming years. TIF provides considerable opportunities to local governments, but it is not without its risks, and making a successful case will be technically and methodologically challenging. Successful adoption of TIF will require careful analysis on a case by case basis.

Steer Davies Gleave is uniquely placed to support local governments seeking to address these and other issues, and capitalise on Tax Increment Financing. We advise local governments throughout the world on strategic transport planning, and possess a suite of economic and transport tools and models designed to evaluate the effects of transport interventions on transportation networks and the local and regional economy more generally.

Bibliography

Anderson, J., & Wassmer, R. (2000). Bidding for Business: The Efficacy of Local Economic Development Incentives in a Metropolitan Area. Kalamazoo, Michigan: W. E. Upjohn Institute for Employment Research.

Briffault, R. (2010). The Most Popular Tool: Tax Increment Financing and the Political Economy of Local Government. University of Chicago Law Review , 77, 65-95.

Brookings. (2009). Value Capture and Tax-Increment Financing Options for Streetcar Construction. Washington DC.

Brueckner, J. (2001). Tax Increment Financing: A Theoretical Inquiry. Journal of Public Economics , 81, 321-343.

Byrne, P. (2005). Determinants of Property Value Growth for Tax Increment Financing Districts. Economic Development Quarterly , 20 (4), 317-329.

Byrne, P. (2010). Does Tax Increment Financing Deliver on Its Promise of Jobs? The Impact of Tax Increment Financing on Municipal Employment Growth. Economic Development Quarterly , 24 (1), 13-22.

Byrne, P. (2002). Strategic Interaction and Adoption of Tax Increment Financing. Champaign, Illinois: University of Illinois at Urbana-Champaign.

Carroll, D. (2008). Tax Increment Financing and Property Value: An Examination of Business Property Using Panel Data. Urban Affairs Review , 43 (4), 520-552.

Casella, S. (2002). Tax Increment Financing: A Tool for Rebuilding New York.

Centre for Transit-Oriented Development. (2008). Capturing the Value of Transit.

Donaghy, K., Elson, A., & Knaap, G. (1999). Optimal Investment in a Tax Increment Financing District. Annals of Regional Science , 33, 305-326.

Dye, R., & Merriman, D. (2006). Tax Increment Financing: A Tool for Local Economic Development. Land Lines , 1-7.

Gibson, D. (2003). Neighborhood Characteristics and the Targeting of Tax Increment Financing in Chicago. Journal of Urban Economics , 54, 309-327.

Kelsay, M. (2007). Uneven Patchwork: Tax Increment Financing in Kansas City. Reclaim Democracy.

Klemanski, J. (1990). Using Tax Increment Financing for Urban Redevelopment Projects. Economic Development Quarterly , 4 (1), 23-28.

Lefcoe, G. Competing for the Next Hundred Million Americans: The Uses and Abuses of Tax Increment Financing. University of Southern California Law School.

Man, J., & Rosentraub, M. (1998). Tax Increment Financing: Municipal Adoption and Effects On Property Value Growth. Public Finance Review , 26 (6), 523-547.

Michel, C. (1996). Brother, Can You Spare a Dime: Tax Increment Financing in Indiana. Indiana Law Journal , 71, 457-479.

Naccarato, R. (2007). Tax Increment Financing: Opportunities and Concerns. Tennessee Advisory Commission on Intergovernmental Relations , 14, 1-11.

Portland Streetcar Inc. (2008). Portland Streetcar Development Oriented Transit. Portland, Oregon.

Weber, R., Bhatta, S., & Merriman, D. (2007). Spillovers from Tax Increment Financing Districts: Implications for Housing Price Appreciation. Regional Science and Urban Economics , 37, 259-281.